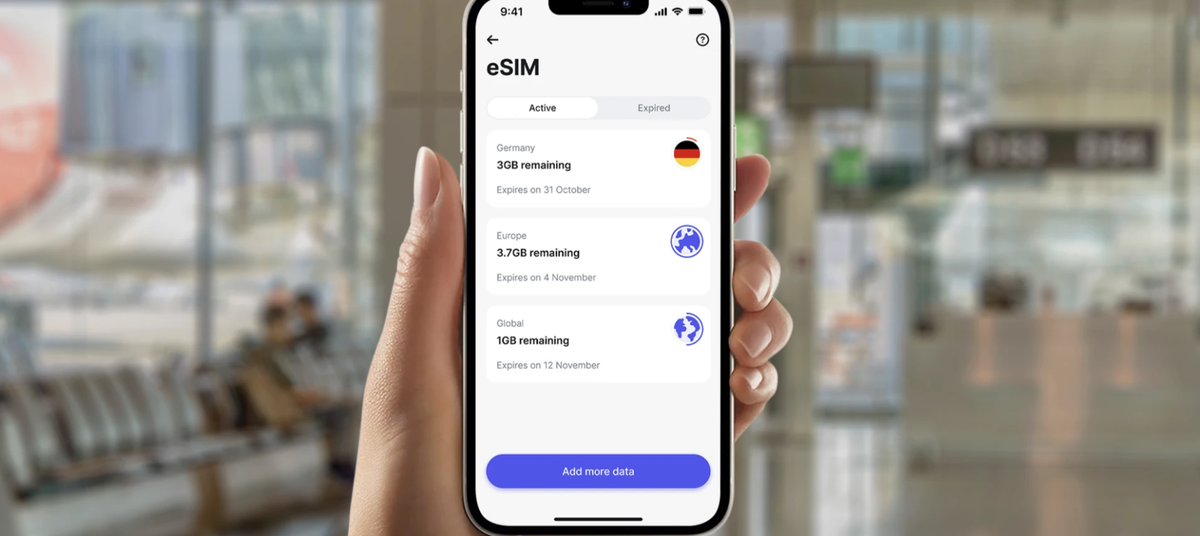

Revolut launches in-app eSIM service; includes 3GB data roaming for Ultra customers

Well now, leave it to the team at Revolut to actually do some innovating in financial services.

The news broke this morning that Revolut have launched an in-app eSIM capability for their customers, enabling them to seamlessly deploy an additional eSIM and purchase roaming data. Additionally, Revolut Ultra customers (of which I am one, thank-you-very-much) will get 3GB/month of roaming bundled into their existing subscription.

Absolutely awesome.

Roaming is still a massive issue — and that’s decades after I started writing about the mobile industry (I started writing Mobile Industry Review in January 2006). I myself have been using Airalo (see post) when I have been flying around the Middle East and found it a really good service. I also used Holafly after Ben Smith had recommended/highlighted them on our 361 Podcast. I found them a little less seamless than Airalo, but still effective.

But I tell you what, the fact I now have 3GB of roaming data ‘included’ with my Revolut Ultra subscription is just genius. That will get me going. That will mean I get off the plane working. And if it’s a good service with good quality fast data — which I trust it will be — then it’s more likely I will top-up in my Revolut account. Because that’s just one less set of friction to worry about.

1Global (or Truphone – remember them?) are apparently the team behind the service – so I expect good things.

Now then.

I am very pleased to see some degree of innovation happening in my twin interests of both financial services and the mobile industry.

For years I have been suggesting (and, if they’ll listen, berating) both markets to look for ways to collaborate.

I set some hearts racing with this post back in 2011 when I wrote an April Fool’s story suggesting that HSBC had purchased UK mobile operator, 3UK. In my slightly warped story, I wrote that HSBC had identified that the mobile industry was simply a (meaningful and useful) dumb pipe to the internet. I suggested that HSBC was going to convert all 3UK customers to £5/month unlimited everything subscriptions on condition that they became banking customers. Something like that. Here’s a quick snippet to that post…

Look around the mobile industry and you’ll see there’s generally absolutely nothing of interest going on, whatsoever. Indeed, the ailing mobile operators who, for years have been spending billions on advisers have failed to do anything imaginative beyond selling minutes, megabytes and — still – text messages.

Speak to any mobile operator today and the vast majority are doing exactly the same as they were doing 10 or even 15 years ago.

They can only think in ‘minutes’.

I think we can see with the current Vodafone horror that management is eventually realising that they are simply a (necessary) utility. Different colours of dumb pipes.

Still very necessary though. I’m still totally happy to pay for connectivity.

Which brings me to banking.

I think it’s a great move to see Revolut experimenting with eSIMs and roaming. Indeed, one might suggest that it’s rather late to the party here given how many Revolut customers use them when they are roaming.

I wonder how long it would take for Revolut to gradually extend their thinking beyond data roaming.

I already pay 3UK something like £17 a month in the UK for unlimited everything. I pay slightly more to Etisalat in UAE for similar. It isn’t that much of a stretch for me to click two buttons and have Revolut take over the ownership of this (certainly the UK number), especially if they could take my existing number and make it ‘international’.

This, after all, is what I was looking for all those years ago from Truphone anyway.

I have always, always liked the idea of banks taking control of these sort of generic services. I know that phrase (“generic”) will strike fear into the hearts of any mobile operators reading, but sadly, this is effectively what they/you are. Required. Critical. But, as is witnessed whenever I travel, totally generic. I just want the data and the base connectivity please.

So if you’re working for a bank – what would it look to your fee income profile across the next 10-20 years if you could do similar to what Revolut is doing?

Great work Revolut. Great work 1Global.