A&L's prepay travel card comes with text-top-up

When I was a young man… and, more and more I’m feeling a bit middle aged (I’m almost 31), I went to Prague with my friend James for 3 days to ‘see a bit of the world’. We were first year students at UCL and we reckoned we should go to Europe every 2nd or 3rd week to really see the place.

The city had only thrown off the Soviet yoke a few years prior to our arrival. There were only two McDonalds, for example.

We stayed at a rather wicked hotel and we got an excellent deal since a travel agent friend of mine had procured that, and the flights.

This was back when I had a 220 pound limit on my Student Barclaycard.

All was good. We had a super time. We, obviously, ate in McDonalds most nights, being rather afraid of actually sampling real Czech food (“they don’t really speak much English do they? And what if they bring us some sheeps eyes or something? … BIG MAC please.”)

Not very adventurous. Ridiculous. I think I ended up having toasted ham sandwiches a lot in the hotel bar too.

Anyway this is related to A&L’s prepay card.

The day before we were due to fly out, my travel agent friend helpfully (i.e. mistakenly) billed our flights to my card. Instead of both our cards, individually.

So my whopping 220 pound’s worth of free credit was erased. I had 2 quid spare, I think.

When we came to check out of the hotel, there was embarrassment all round. My card declined. James’ card declined. And our Switch (“Maestro”) cards weren’t accepted in Prague at that point.

Arse.

After a blank look from James, I was left with no alternative but to phone home and LUCKILY my parents were home.

“I’ve, er, got a bit of an issue,” I explained, whilst the Czech ladies behind the reception desk giggled quietly to themselves at the stupid Brits with no money.

Mum quoted her card number. Balance paid off. All good.

I returned home and promptly took out every single credit card offer I could. Never again will I be stuck in the middle of nowhere without sufficient credit.

But even when you’ve got a perfectly good credit card with LOTS of spare credit, we’re all still subjected to the ‘oh, sorry, it’s declined?’ question — especially when abroad.

The other week I was trying to pay for a bit of hardware in San Francisco and my card declined. Hugely annoying. I’d checked it moments prior to the transaction to *ensure* the transaction would go through smoothly. Despite PHONING the card company to inform them I was abroad… I don’t know WHY I waste my time and money doing that when their computer makes the decisions.

My transaction declines. I smile apologetically and explain that the card is ‘good’. At which point you receive a quizzical look from the retailer (“That’s what they all say, Sir”).

I then explained I’d be back in a moment and I’d phone the bank. I watch as the sales assistant calmly packs away the stuff I was about to buy and takes it back to the storeroom, clearly assuming I was either being a fraudulent arse or just had no money.

Press 1 for credit cards. Blah blah blah. I eventually get through to the ‘speak to an operator’ and… yes… you’ve guessed it. They’re closed. Timezones. GAHHHHH!

This happens even with my uber-shocking buy-a-car-with-it Gold Card. Maybe I need an American Express Black one. I wonder if they do special accounts for mobile industry fans? 😉

Anyway. So what to do?

Get a prepaid travel card.

I got one from Lloyds TSB a while ago and it’s been excellent. I used it all the time in San Francisco with no hiccups. The brilliant thing about a prepaid card is that it’s binary. You either have a balance or you don’t. You can see the credit card computer doing the virtual equivalent of ‘do not pass go, go straight to authorised’.

I really like the confidence that comes from being able to truly purchase something without having the chance of the total rigmarole of having to phone up when the transaction is declined.

The one arse with the Lloyds card? You have to manage it online or via international telephone rates. It’s quite simple as long as you’ve got a web browser. Login, transfer some cash. Spend it on the card.

So you can very easily stick just 100 quid on to the card and fly off to America. Then, if you want to actually SPEND money, transfer another 500 quid. And another 500 quid. Easy to budget and no panics when it comes to refused transactions.

Back to the subject of this post — The Alliance & Leicester Card comes with account top-ups by SMS. Love it. That, I think, is the ultimate in convenience.

Not only can you top up by text, you can also get balance updates and make card to card transfers by text.

This I would pay premium text too. I’d be happy to pay 25p/50p a text to query my balance and make a cash transfer. I like the utility.

So kudos to Alliance & Leicester. Finextra has the relevant news story.

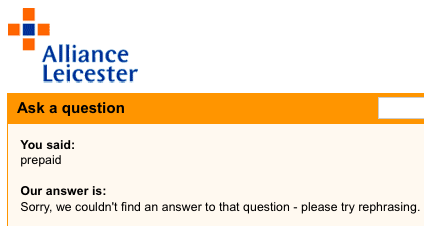

Although negative kudos to Alliance & Leicester’s website designers. Piece of shit. I couldn’t find ANYTHING about this on their site — I was aiming to order — and I did a search for ‘prepaid’ and got this result:

Useless.