Apple leads in key countries as tablet market falls 11% in Q2 2015

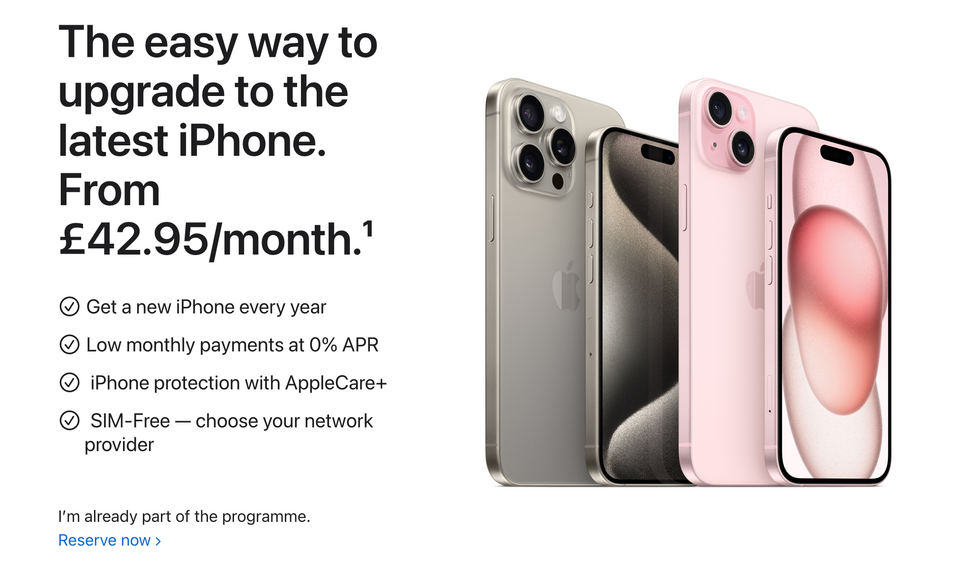

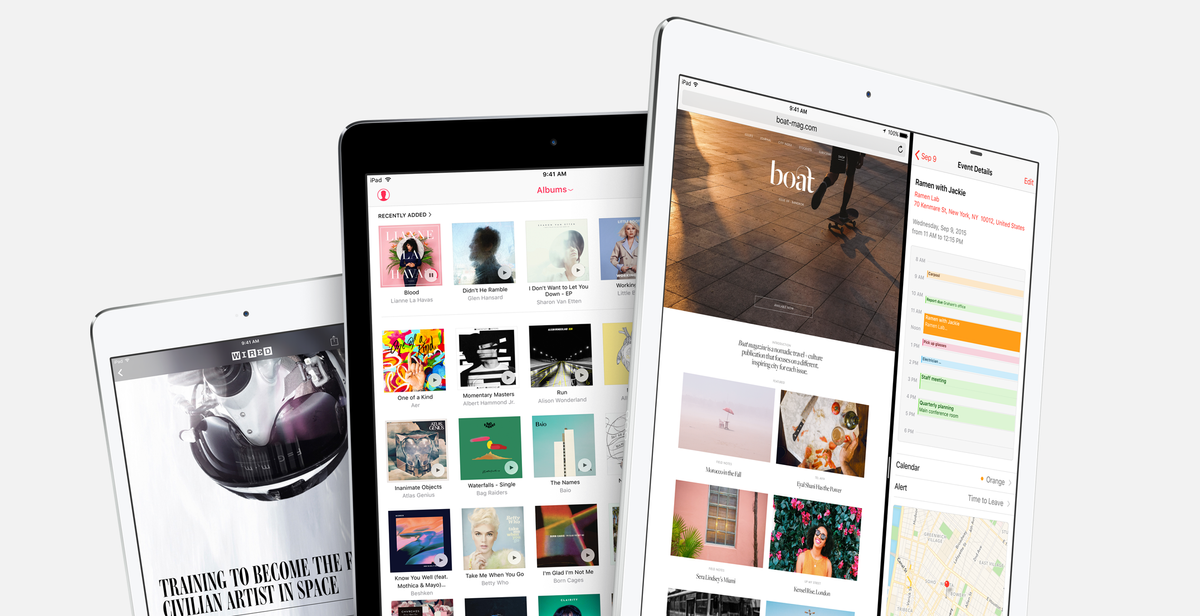

Apple just announced its brand new iPad Pro, a 12.1-inch tablet with a stylus (Apple Pencil), an A9X CPU and 4 GB of RAM, aimed squarely at the enterprise market and well-heeled professionals who need the additional horsepower. The company also updated its iPad Mini, adding a much better screen that matches the iPad in colour gamut and anti-reflective properties (as well as updating it from the A7 chip to an A8 and doubling the RAM to 2 GB). There’s no doubt that the iPad Pro looks like being one of the very best tablets on the market, and impressions so far by the tech press have been largely very positive. But is it enough to revive the tablet market, which is still in a somewhat lacklustre state…?

According to Canalys, tablet shipments continued to wane in Q2 2015, falling 11% year on year to 42.5 million units. After three years of explosive growth, the tablet market peaked in Q4 2013, going into decline a year later. Tablet shipments fell in every worldwide region in Q2 2015, with no reason to believe that growth will return in the short term. Sales in high-growth markets are dwindling as large-screen smart phones grow in popularity to become buyers’ first Internet-enabled devices of choice. In addition, tablets will have to compete against a new wave of two-in-one devices designed to take advantage of Windows 10.

“Despite the sudden downturn in shipments, tablets are certainly here to stay. Yes, they have matured and commoditized quickly, but there are still opportunities for vendors to profit from the category”, said Tim Coulling, Canalys Senior Analyst.

“Unlike consumers, businesses have been slow when it comes to mass adoption of tablets. They are willing to spend more on products that satisfy a specific need and meet key requirements, around durability for example. In the consumer space, demand for premium tablets in established markets has noticeably slowed but is not going to disappear. The top five countries accounted for half the world’s tablet shipments and Apple led in all but one, Brazil. It is well placed to continue leading the market for the time being”.

Meanwhile, here are some fascinating tablet statistics, courtesy of Statista.com:

| Global Tablet Market Overview | Values | Statistic |

|---|---|---|

Worldwide quarterly tablet shipments |

50.4m units | Details → |

Share of U.S. population owning and using tablet computer |

20% | Details → |

Number of 7 inch tablet shipments |

67m | Details → |

Forecasted shipments of tablets by 2018 |

383.8m | Details → |

| Tablet Operating Systems | Values | Statistic |

|---|---|---|

Global quarterly Android tablet shipments |

37.9m | Details → |

Global tablet market share of Apple |

32.5% | Details → |

| iPad, Kindle, Android & Co. | Values | Statistic |

|---|---|---|

Apple’s global quarterly revenue from iPad sales (units) |

7,610 m | Details → |

Hardware costs of iPad 2 |

$326.6 | Details → |

Global Android media tablet shipments |

46.9m units | Details → |

Forecasted market share of Android tablets by 2016 |

38.3% | Details → |

Amazon Kindle Fire unit sales |

23.1m units | Details → |