Is the BT and EE tie-up good for consumers?

By now, everyone who has been following the major news outlets will have heard that British Telecom has announced its plans to purchase UK mobile operator Everything Everywhere (EE) for a reported £12.5 billion. Confirmation of the strategic deal comes just months after BT was reportedly in talks to buy either O2 (owned by Spain’s Telefónica) or EE, in a bid to return to the mobile industry and compete in the quad-play (Internet, TV, mobile and fixed line) business.

BT is in a very strong position right now, but the good times may not last forever. This deal will position the company as one of the dominant players in the UK telecommunications market and strengthen its ability to innovate and offer enticing new services.

In this article, we take a look at the deal and assess what it could mean for you and me.

BT Everywhere

It was widely reported on Monday that BT acknowledged its intention to purchase EE for £12.5 billion, in an exclusive deal with current owners Deutsche Telekom (itself part-owned by the German government) and Orange. According BT, the period of exclusivity will last several weeks, enabling BT to complete due diligence and settle on final terms.

“The proposed acquisition would enable BT to accelerate its existing mobility strategy whereby customers will benefit from innovative, seamless services that combine the power of fibre broadband, WiFi and 4G.” – BT spokesperson

If approved by Ofcom, the telecommunications regulatory body in the UK, BT will own the largest and most advanced 4G network in the country that has the widest coverage and the largest subscriber base. This means BT will be able to more tightly control investment and develop new services that offer a more converged and seamless experience to customers.

It has been reported that Deutsche Telekom will take a 12% stake in BT and have the right to appoint a board member, whereas Orange will have a lower stake but take away more cash.

Why is all this big news?

Essentially because BT and EE will be the single biggest and most important telecoms provider in the country.

Ofcom says that BT is currently the largest home broadband provider in the UK with 31% market share, beating rivals Virgin and Sky (20% each) and Talk Talk with 20%. EE currently has around 3%.

Revenue-wise, EE is by far the largest with over a third of the market – it has 3.6 million 4G subscribers, a much higher figure than Vodafone, O2 and Three. But besides the number of 4G customers, EE has a superior 4G network with more than 74% population coverage, more than O2 (41%) and Vodafone (36%). It’s also come out top in 4G speed surveys such as those reported by Open Signal.

Triple and Quad-play services

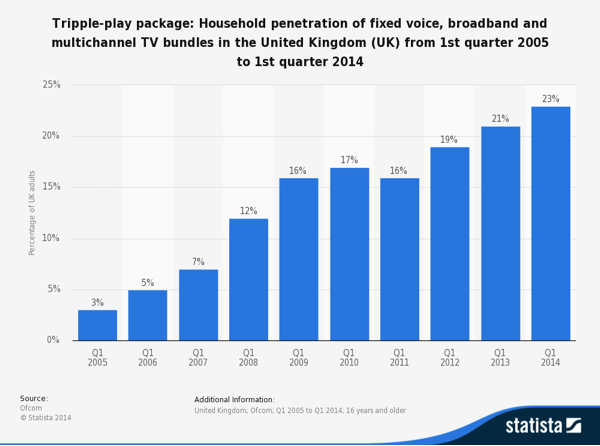

BT exited Britain’s mobile sector when it sold its Cellnet business to Telefónica in 2005 for £18 billion, a move that has been widely regarded as one of the worst moves in corporate history. Since then, BT has been under pressure on all sides especially in its fixed line and broadband businesses, but the telecoms landscape in the UK is a very different one to 2005. Increased competition and commoditisation of mobile networks (essentially becoming just a ‘dumb pipe’) as well as the emergence of triple-play and quad-play services, has made it increasingly difficult to grow revenues.

But the ability to offer quad-play services is considered a cornerstone of BT’s strategy going forward:

“We firmly believe that convergence is the future of telecommunications in Europe. Customers want fixed-mobile converged services from a single provider” – Thomas Dannenfeldt, Chairman of EE’s Board of Directors.

BT badly needs to be able to offer a unified set of services that will reduce retention and encourage new customers, and the buyout of EE will enable it to do just that. BT already offers fixed line, TV (such as the BT Sport service) and broadband, but its rivals such as Virgin Media have the upper hand when it comes to being a one-stop-shop for subscribers’ communications needs.

So what’s the big deal about quad-play? In Europe (particularly countries like Spain), it’s increasingly common to sign up to a single company that provides everything – there’s just one bill (often with steep discounts to sign up) and it means that most people end up paying less than if they used four different suppliers.

Unfortunately, there’s already concern that BT will have to hike prices again for existing customers in order to pay for EE and the additional investment and restructuring costs needed. The company is unlikely to do this in the short term, but it’s definitely a worrying prospect for some customers, particular in these tough economic times.

A good deal for consumers?

Aside from the price hike concerns, the EE deal should enable BT to streamline its IT systems and network, and launch more cohesive services which tie everything together under one umbrella, which should ultimately benefit customers.

Sky, TalkTalk and BT all offer multiple services, but Virgin Media is the only true quad-play provider today. As a a virtual network operator that uses EE as it’s physical network, Virgin may find itself in an awkward situation when BT becomes even more of a competitor.

The BT / EE combination would easily constitute the UK’s largest quad-play provider – having the most mobile, broadband and landline customers and a burgeoning TV business fuelled by the move into sport. Although it may not yet be dominant in any single sector, it’s overall size and reach will make it a force to be reckoned with. This ought to translate into aggressive pricing and attractive deals for new customers as it seeks to grow its market share and capitalise on its increased user base.

There are however a few drawbacks.

It will almost certainly be cheaper to buy all your communications and TV services from the one company, but that may mean it’s difficult to change further down the line. Let’s say that you’re happy with your Internet, telephone and sports package, but the mobile coverage and user experience you receive is terrible. How do you change providers and not incur significant costs to switch? It may cause customers to lose their bundled price benefits and therefore simply put up with inferior service in any one of the products.

Furthermore, rivals like Vodafone and 3 are unlikely to be happy with the deal (this may result in a wave of mergers in Europe in the coming months as they seek to consolidate) as it may be seen as an unfair advantage for BT. In the end, there will be fewer big telecoms providers and inevitably less competition.

How will it play out for consumers? It might take some time to really understand the impact, but it’s also worth bearing in mind that both BT and EE are ranked the lowest for customer service in their respective industries according to Ofcom.

We certainly live in interesting times, and 2015 will reveal whether it’s customers like you and me who win in the end…

Let us known in the comments below whether you think the BT / EE tie-up is a good thing.