How Wireless Will Pave the Path to Neobank Profitability

I’m delighted to bring you an opinion piece from Rafa Plantier at Gigs.com. I think it’s particularly relevant given the recent eSIM news from Revolut. Over to you Rafa:

The last decade ushered in a wave of new entrants knocking at the doors of the traditional banking industry. Described as neobanks, these companies provide their customers with intuitive mobile financial services without the hidden fees often associated with traditional banks.

Neobanks like Chime, Varo, Nubank, Monzo and Revolut have struck a chord with digital native consumers, and collectively they’ve amassed tens of millions of customers in short order with aggressive market and product expansion strategies.

The opportunity ahead looks promising. With a projected transaction volume of $6.37 trillion in 2024 – roughly twice the GDP of the United Kingdom – neobanks have clearly demonstrated their ability to attract new customers, mostly organically, by the millions. But monetizing these customers doesn’t come without challenges.

To date, the revenue model of neobanks has largely been dependent on interchange fees or net interest margin from consumer financing, neither of which are easy to start, nor scale. Interchange revenues from card payments pale in comparison to user acquisition costs – even when ramped up to millions of customers. And on the consumer credit side, both the immense capital required for disbursements and loan loss provisioning, and the losses incurred on defaults stack up quickly, as it takes time to calibrate scoring models.

As a result, most leading neobanks struggle to earn more than $30 per customer each year.

While some have managed to diversify their revenue streams with attractive mobile trading services–mostly equities or alternative assets, like crypto–trading activity has proven to be highly dependent on market fluctuations, making it difficult to generate a steady and reliable flow of income. Premium accounts with monthly fixed fees are pointed to as a natural solution to the problem. While effective in boosting transaction volume and customer loyalty, these paid tiers have yet to demonstrate a significant impact on the bottom lines of most neobanks today.

In other words, the often cited “path to profitability” appears to remain shrouded in fog. With investor sentiment shifting away from growth at all costs to sustainable profitability, this begs the question: What will the neobanks’ next act look like?

The convergence imperative

To thrive in the years ahead, neobanks need to embrace convergence – going beyond simply being better banks, and instead building ecosystems of complementary, value added services. By seamlessly integrating these services with their core banking functions, neobanks have the potential to unlock significant surplus value and provide a more comprehensive and tailored experience for their customers.

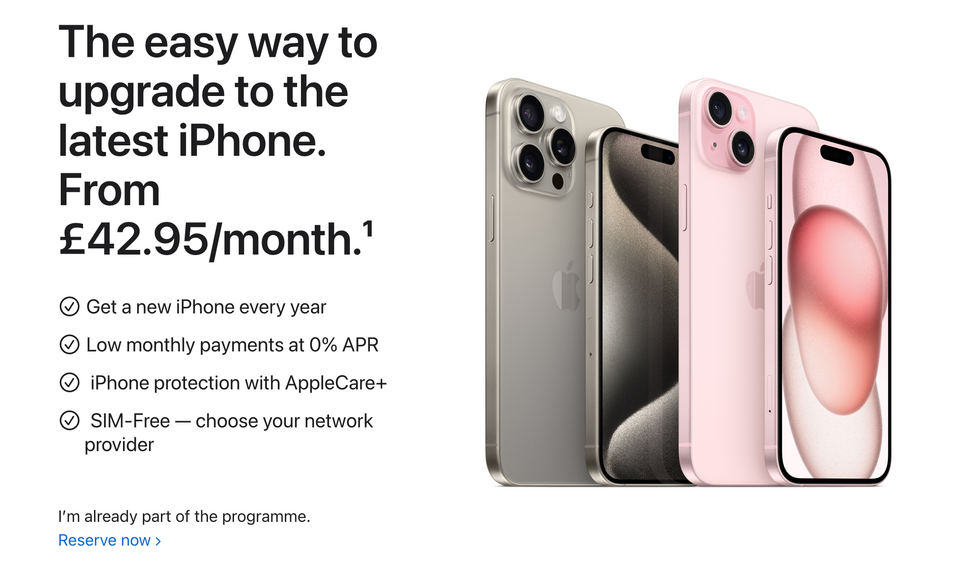

Some are already off to the races. Revolut and Monzo have expanded into travel insurance, while Klarna and Nubank have doubled down on shopping tools like price comparisons or affiliate network discounts. But the most promising candidate has been overlooked so far: Phone plans.

There are several supporting parallels between banking and telecommunications. Both are daily-life essentials, conceptually simple but operationally complex, and highly regulated industries. From a business model perspective, both are easy for new customers to sign up for, but relatively hard for frequent users to switch from, which creates a sticky portfolio over time.

The combination of banking services with connectivity compounds this stickiness, leading to even lower churn and higher lifetime value. By embedding branded phone plans into their offering, neobanks can boost their revenue per customer by multiple orders of magnitude all while differentiating themselves in a crowded, commodified market.

Companies like Zolve and Revolut are great examples of pioneers in this space. Zolve was the first neobank to launch its own wireless service in the US, while Revolut recently announced the addition of travel eSIMs to its product offerings.

The timing for this type of offering has never been better. The major network operators have been closed systems for decades, but the advent of Telecom-as-a-Service is removing the barriers to entering the wireless connectivity space. Much like how Stripe abstracted away the drudgery of payments through modern APIs, Telecom-as-a-Service (TaaS) now enables businesses of all sizes to embed wireless plans directly into their product portfolio, delivering an entirely new product experience to their customers.

With TaaS platforms, neobanks can launch their own branded wireless offering in a matter of hours, as opposed to spending 12-15 months and millions of dollars negotiating and integrating with carriers. This innovation also lifts the costly burden of building software from scratch to offer and manage wireless subscriptions.

By bundling access to multiple different network operators around the world, TaaS platforms enable neobanks to sell their wireless plans worldwide through a single integration – and unlock a new recurring revenue stream through connectivity.

This democratization of access to wireless networks has turned the convergence of digital banking and wireless services into an inevitability. Neobanks have already mastered the art of delivering services digitally, and the adoration from their customers is clearly reflected in their strong NPS positions. In other words, they have what incumbent carriers lack. With the pressure on neobanks to turn a profit rising, it’s not a question of whether this will happen, but who will be the first to achieve mass adoption of their wireless service.

Rafa Plantier is the Head of Go-to-Market at Gigs, and previously held leadership positions at Stripe, Nubank, and Tink.