Microsoft, smartphones and the cloud - a recipe for success?

Is the cloud and mobile-first strategy making any difference?

Microsoft has set its sights firmly on the smartphone market with the acquisition of Nokia. Since the failure of Windows Mobile, its previous smartphone platform, Microsoft desperately needed to unify their struggling mobile hardware and software business. And Nokia, who had been caught off guard by competitors such as Apple and Samsung, needed a much wider audience than it could achieve on its own.

When it comes to smartphone market share, things have not been encouraging for Microsoft – Windows Phone only accounts for a few percent of smartphone sales (even though Windows Phone has been around since 2010, it has yet to exceed much more than 5-6% percent share), a fact that makes Microsoft more determined than ever to attract users to the platform. While the situation might look bleak in the face of Android and iOS’s domination, Microsoft has a great opportunity to win customers by offering more diverse and attractive devices, as well as leveraging its strengths in the business / enterprise market.

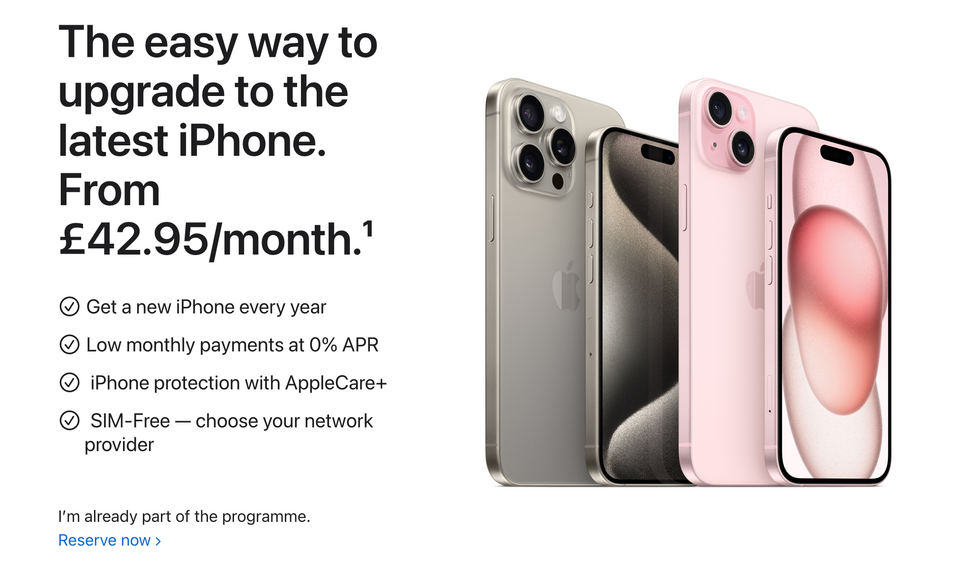

But these days, smartphone hardware capabilities are become increasingly irrelevant (just take Apple, who is often criticised for playing catchup in terms of hardware and features, but consistently sells tens of millions of iPhones). What matters most is a superior ecosystem of cloud-based software and tightly integrated services that work in harmony. And its the relationships with hardware vendors and its own Nokia business that Microsoft can use to redraw the battleground.

What does cloud-first and mobile-first really mean?

Even before the Nokia deal closed, Microsoft was promoting “cloud and mobile first”, in contrast to the “devices and services” ethos espoused by previous CEO Steve Ballmer.

When you look closely at what this really means, it is more of a refocus rather than a change of direction. Since Satya Nadella became the CEO early in 2014, the changes in Microsoft’s overall strategy have become clearer and despite the rhetoric, the opportunities for Microsoft to increase adoption of Windows Phone are there to be taken.

“Microsoft has always been about bringing those three constituents together with platforms and applications, and we now do that in a mobile-first, cloud-first world” – Satya Nadella, Microsoft CEO

Windows was once aimed solely at traditional PCs, but is now positioned to address a much wider market that includes tablets, smartphones and even the Xbox. Microsoft sees all these devices as an opportunity to expand, reflected in their desire to create apps for iOS and Android. And it knows that a vibrant, diverse ecosystem is essential to tie users into Windows. Microsoft will never abandon the PC market, but it’s increasingly emphasising its cloud services and trying to attract customers to its Nokia brand.

Cloud first pays off

When you really think about “mobile first, cloud first” it’s easy to see how the cloud part fits in, because Microsoft can easily take its desktop products and rework them into modern cloud-based services. Consider Office – it has been a mainstay of the enterprise for two decades and has now been re-spun as the subscription-based Office 365.

When it comes to Office 365, the vision is pretty straightforward. It is to make sure that the 1 billion Office users and growing can have access to the high-fidelity Office experience on every device they love to use – Microsoft

There’s also OneDrive, which is baked into Windows 8 desktop and Windows Phone allowing users to store any type of documents in the cloud, and according to Microsoft there are now 250 million active OneDrive accounts with over 11 billion photos stored. Microsoft’s other software products such as Skype and Outlook are also incredibly popular, and could be killer apps in its cloud-based future.

And in the enterprise, Microsoft has positioned Intune and Azure Active Directory as cloud-based mobile device management and identity solutions that help IT departments to manage all the various cloud services used by employees, with clear separation between personal data and sensitive company information. Because it works with Windows, Android, and iOS, it’s a convenient and attractive to IT departments trying to cope with the complexity that ‘bring your own device’ entails.

As far as the cloud is concerned, Microsoft is promoting and investing heavily in the technologies, applications and services, and stands a good chance of making them more ubiquitous and seamlessly integrated into all its smartphone and desktop products. For example, using OneDrive as the default location for Word documents on iPad means that you can pick up where you left off on Office 365 without having to save and copy files manually.

More recently, in a sign that its cloud strategy is starting to pay off, Microsoft announced that commercial cloud revenue has doubled this year to $4.4 billion.

Nokia smartphones – the weakest link?

As much as Nadella has touted Windows, he’s made it clear that Microsoft is focusing on cross-platform strategies, highlighted by the Office for iPad release in March this year. Those apps (Word, Excel and Powerpoint) quickly rose to the top of the iPad charts – as a freemium model they are available free to view documents but require an Office 365 subscription to create documents. But by creating compelling products on rival platforms, Microsoft hopes to extend the reach of its most popular applications that users are already familiar with and use every day. With Office on iPad, Microsoft has got off to an encouraging start.

However, Microsoft still needs Windows Phone and the Nokia brand to succeed if it wants to remain relevant in the mobile space. And it’s in the more lucrative mid and high-tier segments that Microsoft remains a niche player, though at least in public says it’s happy with third place for now.

Why are Nokia Lumia sales less than inspiring? It’s certainly not hardware capabilities that are the problem; its flagship devices such as the Lumia 930 have been well received by the tech press and offer impressive specifications (for example high-end cameras, quad-core processors and full HD displays) that in many cases exceed what the iPhones offers.

There are also plenty of big name Windows Phone apps in the store now, but Microsoft needs to do more to attract developers who often ignore Windows Phone or that develop for iOS and Android first. Microsoft has improved its developer tools to make it simpler to create apps in Visual Studio, but it’s a chicken and egg situation: without the app store revenues developers won’t create apps, and without the apps consumers won’t buy a Nokia smartphone. There is still much more to do to address the problem; perhaps the ability to develop cross-platform apps in Visual Studio that work on all those devices would make it a no-brainer for software developers?

Finally, Microsoft has hinted it will drop the Nokia brand name at some point in the future. Perhaps that change needs to happen more quickly, as a single Windows brand would simplify its marketing message. Moreover, a truly common OS (Windows 9) on the desktop and Windows Phone would allow developers to create a single application that works on every device. If Microsoft does consolidate Windows, it may help to gain smartphone share and become a legitimate rival for Android and iOS.

Microsoft’s smartphone business looks promising and for now seems to be taking the right approach with its cloud and mobile-centric strategy. It remains to be seen how effective this will be, and whether it translates into higher sales for its Nokia smartphones and Surface tablets.

You can read more about Apple’s Enterprise strategy in our related post.