The mobile payments revolution

Mobile payment schemes are a hot topic at the moment, fuelled by revelations about Apple’s forthcoming Pay service which is about to be rolled out in the U.S. this month.

The concept is not new: the technologies and infrastructure that enable you to pay with your smartphone have been around for well over a decade. And in countries like Kenya, mobile money transfer and payment systems such as M-Pesa have long been the preferred payment method, especially for small value transactions or micro-payments.

Consumers in the UK have also been paying via touch-enabled credit card readers for years, but the advantage of a take-it-with-you-everywhere mobile wallet is that you just tap your smartphone at the till to make a payment. But there hasn’t been (and still isn’t) a common system that everybody can use no matter what device they own. Sure, there are standards that specify certain aspects, but the sheer number of competing mobile payment, e-wallet and virtual money services is mind blowing.

Even the UK’s mobile operator Three had a small team of people working on “m-pay” solutions as far back as 14 years ago. The idea was similar – use your smartphone as an e-wallet or even an alternative to the Oyster travel card, and get charged on your phone bill. It was ahead of its time, because as far as I know none of the UK’s mobile networks have yet deployed a mobile payments system that has achieved any kind of success

Is it now too late for the operators? Probably, after all would you rather use Google Wallet and Apple Pay, or Vodafone’s mobile wallet? (Check out an older post on that very subject here).

Consumer attitudes to mobile payments

Despite the huge potential, consumers remain wary (and apathetic) towards mobile payments for several reasons. Chief amongst these are concerns about security (46% of U.S. consumers surveyed cited this as their primary concern), or that it’s just easier to pay with cash or a credit/debit card.

Perhaps surprisingly, 32% of respondents said they had never even thought about digital wallets. Clearly, there is a lot to be done in terms of marketing and informing the public of the benefits.

The market for NFC (Near Field Communications) transactions in the UK (on which many of these services are based) is estimated to reach $10 billion (£6.2 billion) by 2016 – that includes mobile payments such as Google Wallet and Pay. It wouldn’t be a surprise if the UK market exceeded that figure, as the survey referenced below was conducted before the biggest fruit-shaped company on the planet joined the fray.

Jumping on the bandwagon this week, Asda and Sainsburys just announced they will accept mobile payments from next year in a scheme called Zapp. It looks great on paper, but it looks like customers will have to open the smartphone app at the checkout, choose an account and then tap in a code. While it’s great to have more diversity and a choice of payment options, ease of use might be the biggest barrier to adoption. But at least for iPhone users, the most convenient option will be the one that’s already built into the phone!

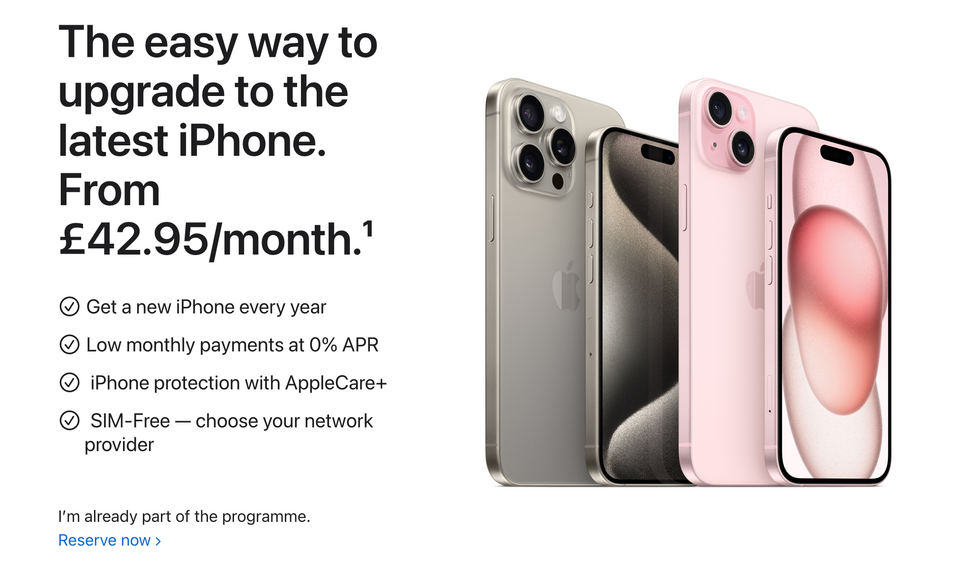

Apple Pay

It’s impossible to discuss digital wallets without mentioning Pay. Apple’s service was announced in September and will be launched this month, in the US at first. It will only work with the new iPhone 6 and iPhone 6 Plus, but should also be compatible with older iPhones when paired with the Apple Watch.

The iPhone 6 includes a special chip called the Secure Element which stores your payment information (in addition to name, address, and delivery details) and encrypted security codes that are unique to each transaction. Apparently, none of this is ever sent to iCloud or Apple’s servers and actual credit card numbers are never used. That’s reassuring, especially after the celebrity photo leaks a few weeks ago…

“Apple doesn’t know what you bought, where you bought it, or how much you paid. The transaction is between you, the merchant, and the bank.” – Eddy Cue, Apple

I have to admit that Pay looks extremely simple to use. To make a purchase requires only a single step: hold the iPhone near the payment machine and use Touch ID. That’s all there is to it from the customer’s perspective: convenient, simple and with built-in fingerprint security. It can also be used online in a similar manner as long as merchants add support to their apps.

Apple has already struck deals with major credit card companies (Visa, Amex and MasterCard) and banks (Bank of America, Capital One, Chase, Citi, American Express, and Wells Fargo) in the U.S., as well as huge retailers like Starbucks, McDonalds, and Walgreens. With this level of adoption by the industry and tens of millions of Apple Pay devices already in the wild, Apple surely stands a fair chance of success?

But it’s the retailers who must be rubbing their hands in anticipation because Apple users are the most valuable online shoppers – and it’s only going to get easier for them to make purchases online and in stores.

This all sounds great, but it’s too U.S-centric at the moment. When can we expect Apple Pay come to the UK and Europe?

No doubt it will be a slow and steady rollout as deals are made with local banks and credit card companies. And in developing countries (where NFC-enabled credit card readers are less common), Apple Pay might not even be available for years.

Where do Google and PayPal fit in?

PayPal is the most popular digital wallet app/service with 79% of users, followed by Google Wallet at around 40%. But Google might have the upper hand when it comes to smartphone payments, as it directly controls Android and is able to work directly with manufacturers to include support for the essential hardware features like NFC.

Google Wallet itself is similar to Apple Pay, but (on most phones at least) can’t use fingerprint recognition to authorise payments. It does however offer some other useful features such as a physical card that can be used at ATMs and stores to withdraw/pay from the wallet.

Additionally, Google Wallet is available for Android and iOS, but it’s unlikely that the majority of Apple users would flock to it when Apple Pay is already baked in.

So, is the mobile payment revolution about to happen? Or will it going to face an uphill battle due to concerns about security, ease of use, or lack of retailer support…?

Let us know in the comments below whether intend to use Apple Pay or another mobile payments system…

You can also read more about Ewan’s thoughts on digital wallets and mobile payments in a related post.