What's the best way of buying a phone today?

How did you buy your latest phone? I’m asking because I’m thinking about what I should be doing.

When I was living in Oman, I did the following for my iPhones, iPads or Samsung Ultras:

- I WhatsApped the team at GadgetsOman (note: see my GadgetsOman post) and asked if they had the phone in stock. Invariably they would say yes, or there would be a few days wait for them to get hold of it. They would then deliver it to wherever I was – either work or home.

- I would then pay with my bank credit card for the full price of the phone.

- I would then wait for the bank’s credit card system to send me a text message the next morning, asking if I would like to spread the cost of [whatever], say 400 OMR (£800), over 3, 6 or 12 months. This was basically like a rather simple Buy Now Pay Later (“BNPL”) thing.

- I would usually go for 6 months – at 0% interest.

I liked that approach. It worked well.

Here in the UK, well it’s a slightly different story. There are so many potential options.

There’s obviously the mobile operator contract arrangement. I don’t think I’ve purchased a phone this way for almost 8 years, perhaps longer.

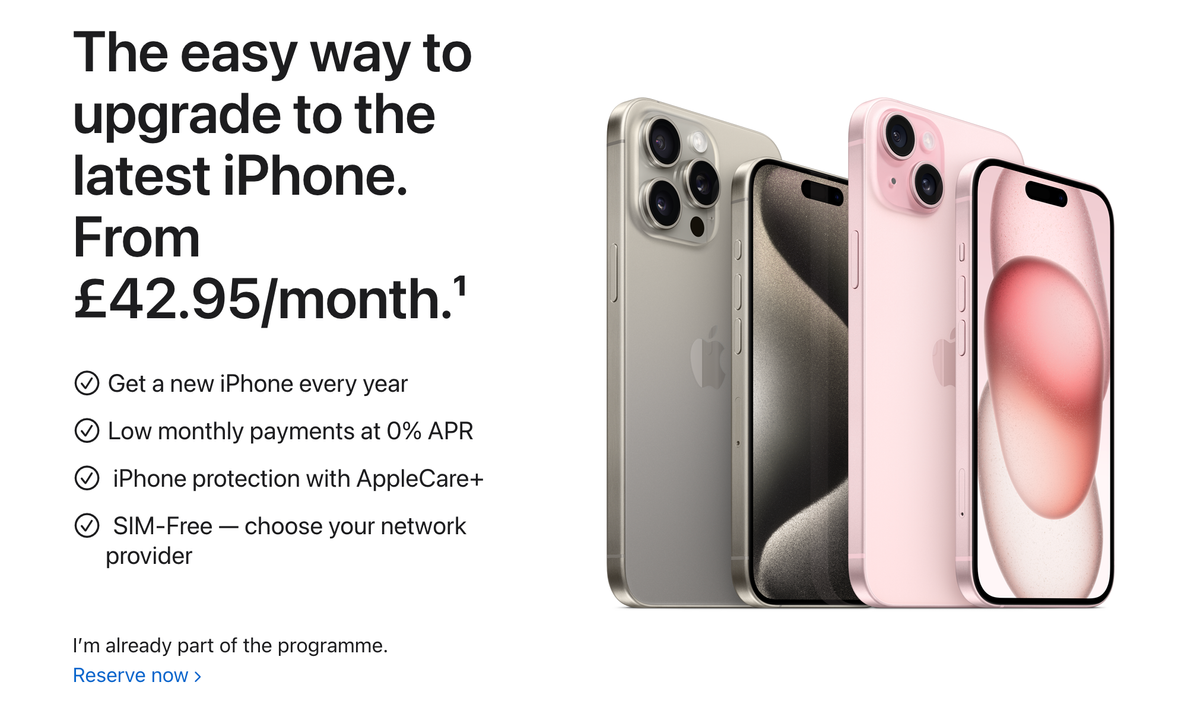

I’ve been thinking a lot about the subscription concept. I know many who are ‘subscribers’ to the iPhone with Apple’s offering (“the iPhone Upgrade Programme“), or they use the Samsung equivalent (“Samsung Flex“) for their S24 Ultra.

Then there’s my absolute favourite – very. I have had an account with them for what feels like decades. I love, love, love buying my technology from there, simply because they offer either a “take 3” option (split the payment into 3) or you you can choose 12 months interest-free if the item is £300 and above… every phone qualifies, right? (Do make sure you pay off the amount within 12 months or there’s a 44.9% interest charge….)

Other obvious possibilities – Klarna, of course. Then there are various other BNPL style approaches.

Apple offers financing from Barclays for anything over £399 and PayPal Credit is also an option they support. I’ve actually used PayPal Credit a lot in the past for device purchases too – as a form of ’12 months interest free’ or similar.

There is quite a bit of choice.

I’m interested to understand what you, dear reader, are doing nowadays?

What’s your policy when you’re buying smartphones, tablets and computing equipment?